Dubai’s real estate market offers investors two primary options: ready homes and off-plan properties. While ready homes allow for immediate occupancy and rental income, off-plan properties often provide better long-term returns on investment (ROI). With Dubai’s thriving economy, continuous infrastructure development, and attractive investment incentives, many buyers prefer off-plan projects for their potential capital appreciation and lower upfront costs.

This article explores the key reasons why off plan properties in Dubai offer better ROI than ready homes, helping investors make more informed decisions.

1. Lower Purchase Prices and Attractive Payment Plans

Off-plan properties are generally sold at prices lower than comparable ready homes. Developers offer competitive rates to attract buyers early in the construction phase, giving investors the opportunity to lock in a favourable purchase price. Additionally, the value of the property tends to increase as the project progresses toward completion, resulting in higher capital appreciation.

Many developers in Dubai also offer flexible payment plans, such as post-handover options, allowing buyers to pay in instalments over time. This reduces the financial burden, making off-plan properties more accessible for investors. In contrast, buying a ready home usually requires higher upfront costs and a full payment at the time of purchase.

2. Potential for Significant Capital Appreciation

One of the primary reasons off-plan properties provide better ROI is their potential for capital appreciation. Property values tend to increase as the development nears completion, particularly in Dubai, where new infrastructure and amenities often boost the appeal of emerging neighbourhoods.

For example, off-plan projects in areas like Dubai Creek Harbour, Dubai Hills Estate, and MBR City have seen significant price growth over the years. Investors who purchase early in the development phase can benefit from this appreciation, often selling the property at a premium before handover or shortly after completion.

3. Access to Exclusive and Prime Locations

Many off-plan projects are launched in newly developed or premium locations that offer significant long-term value. Some of the most sought-after areas in Dubai, including Bluewaters Island, Downtown Dubai, and Dubai Marina, frequently release new off-plan projects with cutting-edge designs and state-of-the-art amenities.

By investing in off-plan properties, buyers can secure units in prime locations that may not be available on the secondary market. As these areas develop further with additional infrastructure and lifestyle facilities, the value of the property increases, enhancing the investor’s ROI.

4. Customisation and Modern Amenities

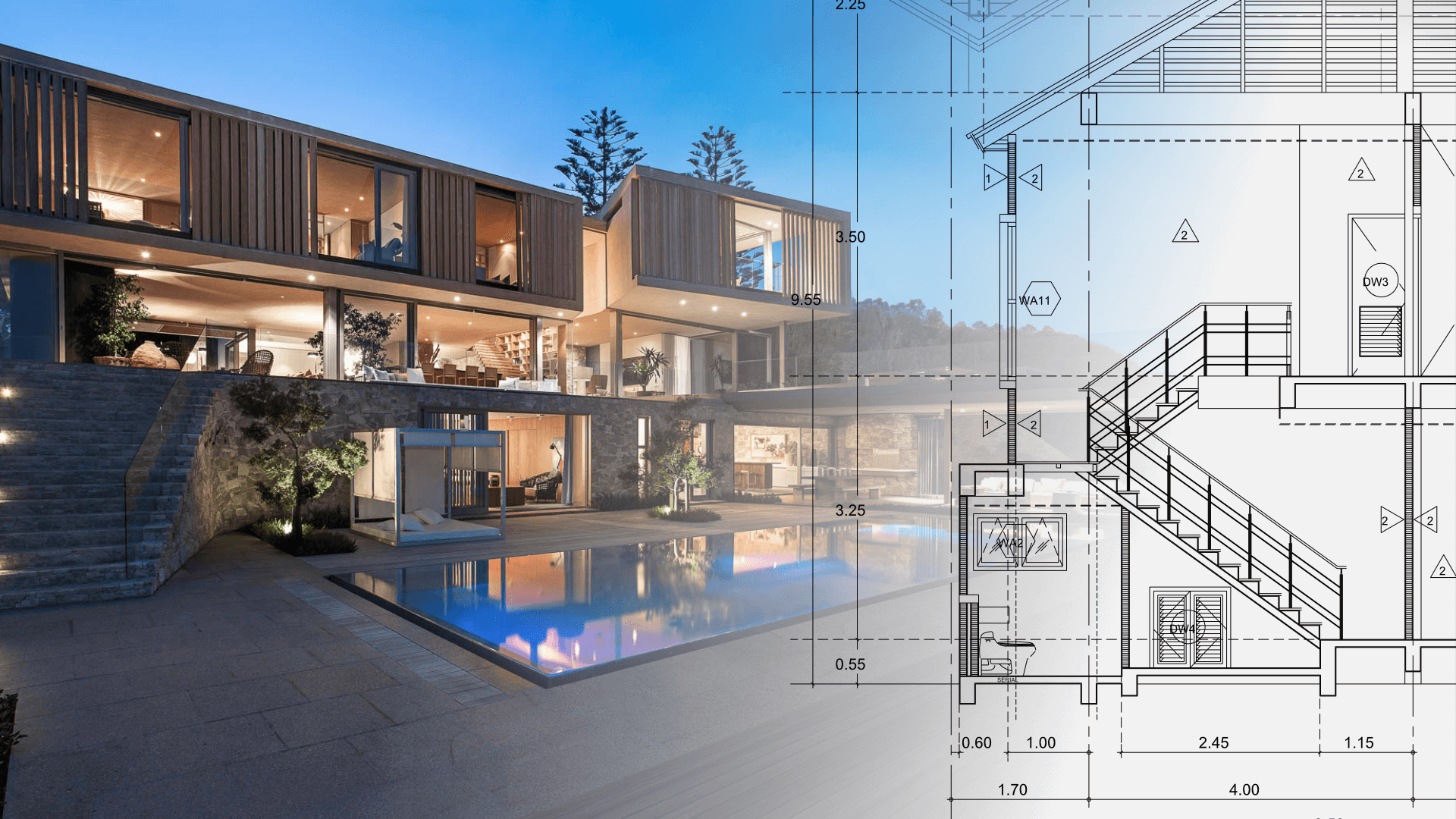

Off-plan properties often come with the latest architectural designs, energy-efficient features, and modern amenities. Developers in Dubai understand that buyers seek contemporary living spaces with high-quality materials and innovative layouts. Off-plan buyers also sometimes have the flexibility to customise certain aspects of the property, such as interiors and finishes, making it more appealing to future tenants or buyers.

Ready homes, on the other hand, may require renovations or upgrades to meet current market standards, adding to the investor’s costs and potentially reducing ROI.

5. Reduced Maintenance Costs and Warranty Coverage

Investing in off-plan properties can also result in lower maintenance costs. Since these properties are brand new, the need for repairs or upgrades in the first few years is minimal. Additionally, developers often provide warranties that cover defects or structural issues for a specified period after handover, offering peace of mind to buyers.

In contrast, ready homes may come with hidden maintenance issues, requiring immediate repairs that can reduce profitability and impact ROI.

6. High Rental Yields in Emerging Areas

Dubai’s real estate market is known for offering attractive rental yields compared to other global cities. Off-plan properties located in emerging areas with future infrastructure developments are especially appealing to tenants. For example, communities like Al Furjan, Jumeirah Village Circle (JVC), and Dubai South are attracting both residents and investors with affordable rents and high-quality living environments.

Investing in an off-plan property in such locations allows buyers to position themselves for higher rental income once the property is complete, thereby increasing ROI.

7. Favourable Market Conditions for Off-Plan Buyers

Dubai offers several incentives to off-plan property buyers, including reduced fees and lower service charges. In recent years, government initiatives such as extended visas and 100% foreign ownership of property have further stimulated interest in the off-plan market.

Additionally, developers often offer promotional discounts, such as waiving the 4% Dubai Land Department (DLD) registration fee, further enhancing the attractiveness of off-plan investments.

8. Greater Flexibility in Selling Before Handover

Another advantage of off-plan properties is the option to sell the property before handover, also known as property flipping. In Dubai’s dynamic market, investors can capitalise on rising demand and sell their off-plan property at a premium once construction is near completion.

This strategy offers quick profits without the need for long-term property management or rental commitments, resulting in faster ROI compared to holding a ready home for several years.

9. Lower Competition in the Early Stages

Investing in off-plan properties also gives buyers a competitive edge. Since the property is still under construction, there is often less competition among investors compared to the ready home market. This allows early buyers to secure prime units with better views, layouts, or locations within the development, enhancing the long-term value of their investment.

By the time the project is complete, demand may have increased significantly, offering investors a better chance of achieving higher returns when selling or renting the property.

10. Tax-Free Environment and Visa Benefits

Dubai offers a tax-free environment, which is another significant advantage for property investors. Income generated from property sales or rentals is not subject to tax, allowing investors to retain more of their profits.

Moreover, off-plan property investments can qualify buyers for long-term residency visas, including the 10-year Golden Visa. These benefits make Dubai an even more attractive destination for investors looking to maximise ROI without worrying about additional tax burdens.

Conclusion

Off-plan properties in Dubai present a compelling opportunity for investors seeking better ROI than ready homes. With lower purchase prices, flexible payment plans, and the potential for significant capital appreciation, off-plan investments provide substantial long-term benefits. Additionally, buyers gain access to modern amenities, prime locations, and favourable market conditions that enhance profitability.

While off-plan properties do carry some risks, such as construction delays or market fluctuations, these can be mitigated by working with reputable developers and consulting experienced real estate agents in Dubai. With the right approach, investing in off-plan properties can unlock exceptional returns and secure a profitable future in one of the world’s most dynamic real estate markets.

By carefully selecting projects and taking advantage of Dubai’s unique incentives, investors can maximise ROI and position themselves for long-term success in the property market.